reNature closes its first seeding round with four impact investors joining DOEN Foundation and Meraki Impact in supporting the transition to regenerative agriculture. reNature Investment BV raised a total of EUR 400,000 in 2020, an important milestone for the startup which is also closing its first full year of operations. With the pre-seed round reNature received a total investment of EUR 550,000.

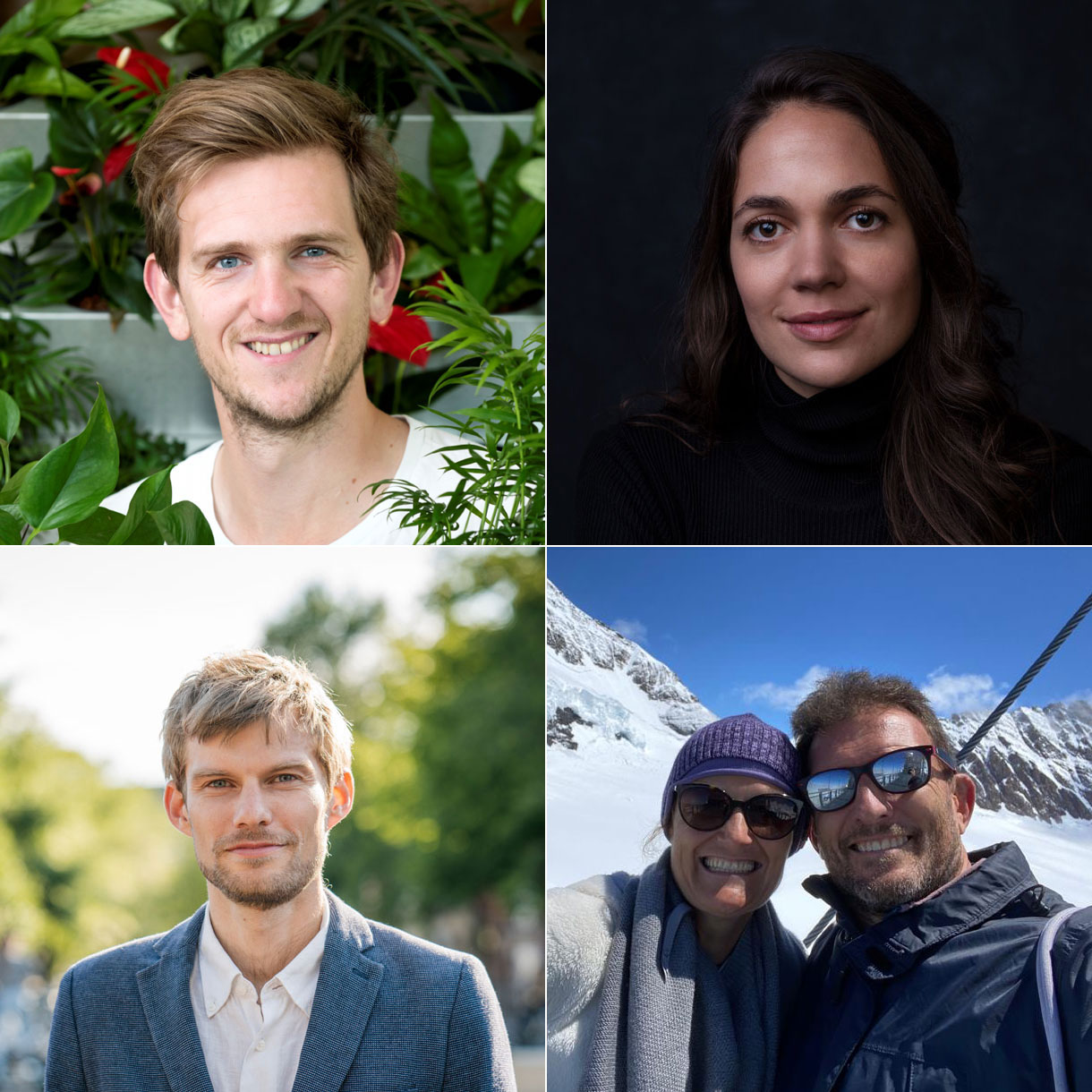

Arne Driessen, Josephine Korijn, Koen van Seijen and Simon Pickard will be joining existing investors in supporting reNature going forward. Their vast experience in the field of impact investment and regenerative agriculture will be a valuable and important contribution to reNature.

The investment will support reNature’s growth plans by increasing work capacity to respond to the increasing demand for regenerative agroforestry.

Arne Driessen is fund manager of Golden Bird, an impact-oriented family fund based in the Netherlands. Their goal is to accelerate the transition towards regenerative agriculture by investing in innovative food & tech companies. reNature fits perfectly into that focus.

Josephine Korijn is co-founder of New AJE Capital, investing their time, capital, and voice in solutions that regenerate resilient ecosystems within the agricultural and food systems, as well as support the transition to more sustainable land use practices.

Koen van Seijen is Senior Manager at the nonprofit Toniic and partner at a financial advisor in Milan, and published more than 100 podcast interviews with impact investors, fund managers, farmers and many others. under "Investing in Regenerative Agriculture and Food”.

Simon and Murielle Pickard are impact investors with a particular focus on agriculture and are based in Geneva, Switzerland.

Meraki Impact manages a venture capital portfolio of funds and co-investments focused on the sustainability of natural resources and food production for a family office.

Doen Foundation, the fund of the Dutch Charity Lotteries, believes that a green, social and creative society is possible. DOEN's role is to support pioneers in the first phase, to jump-start initiatives and thereby stimulate innovation.

We’re facing a turning point in the history of agriculture. We’re convinced that we as reNature have the ability to spread the knowledge of regenerative farming with the help of international experts. The closing of this last investment round gives us the financial space to make it happen.Marco de Boer, CEO @ reNature

We’re incredibly excited and humbled to have Arne, Josephine, Koen and Simon join us as investors. Besides the funding, which will help us achieve our targets, their experience and network will be of great value to reNature.Eva Teekens, CIO @ reNature

We joined reNature in 2019 convinced of the enormous impact it will have on changing our food system. It’s great to have an amazing group of like minded impact investors joining us in this mission, and allowing reNature to jump to the next level with more structure to grow.Fernando Russo, Meraki Impact

reNature Investments BV (reNature) is a Dutch for-profit organization. reNature develops and implements regenerative agriculture and agroforestry systems that generate both short and long-term income for the local farmers & community and have a positive impact on the environment.